Partners in WMK’s Strategic Opportunities equity strategy as well as CFC Required Reserves investments earned reasonable returns in 2025. Our portfolios were conservatively positioned, reinforced by our guiding ethos to own businesses resilient to a range of macro and micro economic environments.

Market Commentary

The equity markets continued to be incredibly resilient, weathering slower economic conditions and trade wars driven by tariffs (plus a few real wars). The S&P 500 remains robustly valued at 22.2x earnings. Two major themes of 2025 are highlighted below.

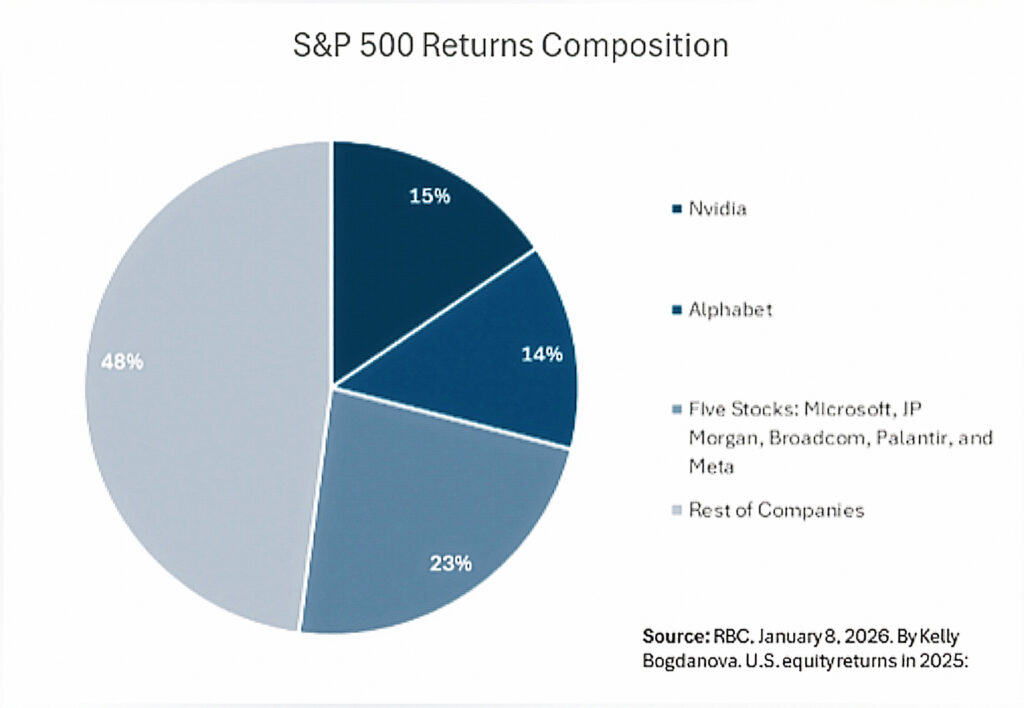

Concentration of Returns: The “Magnificent 7” (Nvidia, Tesla, Alphabet, Meta, Amazon, Microsoft, and Apple) continue to be an incredibly large and important piece of global equity indices. Interestingly, in 2025 the S&P 500 once again delivered robust performance driven by seven companies, but there were a few new drivers, including: JP Morgan, Broadcom and Palantir. Palantir trading at 185x earnings will not be commented on here.

The concentration of returns is appropriate given the mediocre macroeconomic environment. Underlying the optimism for artificial intelligence and any related expenditure (i.e. data centers), there has been continued pressure on the consumers and an incredibly weak freight environment. In fact, freight volumes have suffered 13 straight quarters of weakness – the longest stretch in market history.

International Strength: In 20205, MSCI EAFE (Developed Markets Ex-U.S.) rose +31.2%, outperforming the S&P 500 (+17.9%). The source of outperformance was not driven primarily by valuation or business performance. Instead, a huge variable was U.S. Dollar weakness. The local currency MSCI EAFE index rose 20.6%, indicating ~1/3 of the international return was currency driven.

Dollar Index (DXY) fell nearly 10% in 2025, its steepest annual decline since 2009. This is not entirely surprising as WMK’s 1Q 2025 update discussed the potential for flow of funds to be fundamentally altered by the U.S. Government’s stance on local competitiveness and tariffs.

Another data point that underlies the U.S. Dollar debasement trade is the rise in gold prices, which rallied from $2,600 to $4,300 in 2025 and have continued to grow during 2026.

The impact of the U.S. Dollar depreciation is material. Impacts include the competitiveness of U.S. companies (still incredibly strong) as well as the relative valuation discount of international markets, which remains significant.

Equity Portfolio Update: Discipline Over Narrative

As a reminder, we view our Strategic Equities portfolio as a conglomerate of businesses that we are happy to own for years absent any trading. We are benchmark agnostic, viewing our businesses as private ownership vs. public trading.

Our exposure to headline AI growth has been modest as we view the current business models as challenging. However, we are very exposed to long-term trends within AI, which is a transformational technology. For example, the benefits of AI in areas like operating expense reduction and inventory monitoring in large retail ecosystems like Walmart de Mexico and Alimentation Couche-Tarde are extraordinary.

More specifically, we have been happy shareholders of Alphabet for years, viewing the business as undervalued relative to its long-term earnings potential due to concerns around whether AI would fundamentally displace Google’s core search business. However, in the second half of 2025, Google’s Gemini 3 Pro became the top-ranked AI model on several industry benchmarks, causing OpenAI’s CEO Sam Altman to reportedly declare a “code red.” Of particular interest to the rest of the AI ecosystem is that Gemini is built entirely on Google’s proprietary TPUs (Tensor Processing Units) vs. Nvidia’s GPUs. This vertical integration is powerful to the long-term economic success of AI for Alphabet vs. their competitors.

Alphabet’s AI excellence helped power a 65% return for the year. Despite the strength of the stock, it trades at 30x earnings with strong anticipated future earnings growth. The company is well positioned for today and for tomorrow, making us comfortable continuing to own this extraordinary business.

Another position worth highlighting is Perimeter Solutions (PRM), which gained a robust 115% in 2025. The performance was driven by two key developments:

- The importance of fire retardants as a proactive initial attack strategy by U.S. agencies was proven out by increasing fire retardant sales despite a reduction in total acres burned.

- The strength of management was highlighted in the acquisition of Medical Manufacturing Technologies, which should add ~$50MM in EBITDA annually at a valuation of ~14x.

PRM performing on their core business while management improves their long-term prospects is fundamental to the types of opportunities we hope to have in our conglomerate. Owning this business at below market valuations remains attractive, but we are actively looking to harvest some gains and role these into compelling future opportunities as well.

WMK believes the market will present opportunities over the next year to add high quality businesses at attractive rates of return.

CFC Required Reserves: Conservatism with Intent

Many of WMK’s Partners – including our Founder – own reinsurance entities structured as Controlled Foreign Corporations. These businesses require a conservative investment posture, with at least 85% of assets invested in high-quality fixed income.

Within this constraint, our objective remains clear: preserve capital, maintain liquidity, and earn a reasonable return without exposure to undue interest-rate or credit risk.

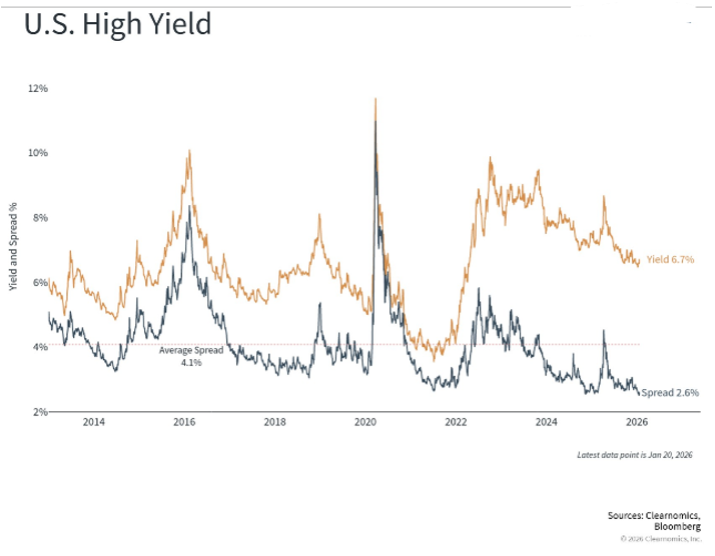

The fixed income environment during 2025 was characterized by compression in corporate spreads vs. Treasuries. The spread compression has been so extreme that high yield bond spreads reached pre-GFC levels of 2.9% and investment grade corporate bond spreads contracted to 20-year lows of just 0.47%. These valuations offer little reward for incremental risk and run counter to our ethos of not owning “return free risk.”

WMK’s core CFC portfolio has been positioned appropriately for this environment, with below market exposure to corporate bonds and an incremental allocation to government secured mortgage-backed securities. This portfolio construction offers a yield-to-maturity of 5.4% vs. the broad U.S. AGG bond index of 4.4% with a duration of 4.7 vs. 5.8 for the AGG index.

Looking Ahead

We enter 2026 with humility and confidence: humility about our ability to predict markets, and confidence in a process designed to endure.

Our focus remains unchanged, owning durable assets, structuring portfolios conservatively where required, and making decisions with a long-term mindset. While markets will inevitably fluctuate, we believe disciplined positioning and thoughtful risk management provide the best foundation for compounding over time.

Disclosures:

The views expressed above are those of WMK Investment Partners. These views are subject to change at any time based on market and other conditions, and WMK disclaims any responsibility to update such views.

Past performance is not indicative of future performance. Principal value and investment return will fluctuate. There are no implied guarantees or assurances that the target returns will be achieved, or objectives will be met. Future returns may differ significantly from past returns due to many different factors. Investments involve risk and the possibility of loss of principal. The values and performance numbers represented in this report do not reflect management fees. WMK may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. To the extent that certain of the information contained herein has been obtained from third-party sources, such sources will be cited, and are believed to be reliable, but WMK has not independently verified the accuracy of such information.